If you’re unsure about how to approach this area, we can help with superannuation and guide you in the right direction. Compare fees and check what your fund invests in. Reviewing your super fund is also important. Having that money put away will take a lot of stress out of managing your financials.

Work towards getting $2000 in there and save it for a rainy day. Consider opening a new account, which Pape calls the Mojo Bucket. You should be paying zero bank account fees, and if you are being charged, then switch to a new bank ASAP. Start looking at things such as the fees you’re paying on your everyday accounts and your super fund. If one or both of you isn’t there yet, monthly date nights are a great way to start the discussion. This means both parties in a relationship too. So much nicer than those crappy after work convos at home!Įveryone should be aware of their financial situation. You might want to try a new place each month, but remember to keep it fun and something you look forward to. Make it enjoyable by reviewing everything over a glass of wine and some delicious food. Date nights are the perfect way to track how your financial goals are going and if you’re sticking to the steps. Then take yourself out for dinner (paying with cash, of course) to celebrate.Book them in with your partner, or yourself – now. And if they get out of hand, they destroy your self-confidence.”īasically pay it off and chop it up. Make no bones about it, the game is designed that way.” Which is pretty scary, amiright?Īrguing that ‘credit card’ is essentially a euphemism for ‘debt card’, Barefoot claims that “debt cards make everything more expensive. He says: “The biggest purchase you make on your credit card is interest. Plastic ain’t fantasticīarefoot truly wants you to be able to escape credit card culture once and for all. (Or, if like Scott, your family home burnt down in bushfires. It gives you the confidence that you’ve got some backing if everything were to go pear-shaped. He says that making sure you’ve always got a minimum of $2000 in savings allows you to reclaim power over your own finances and help you feel financially secure. Always have at least $2000 in your savingsĪ Mojo fund is a staple of Barefoot’s financial plan. Do this and thank us (well, our shoeless friend) in 40 years time. Imagine how many miniature ponies he could surround himself with if he’d taken control of his Super at the start?īarefoot encourages you to consolidate all of your Super into one specific fund, the Hostplus Balanced Index Fund. $85,000 skimmed off the top of his hard-earned cash. He cites an example of one man who paid over $85,000 in fees throughout the course of his working life. He dubs it ‘the greatest tax dodge in Australia’, but makes it clear that professionals in the Super industry are getting rich off of our life savings. Taking control of your Superfund is fundamental to ensuring long-term wealth, says Barefoot.

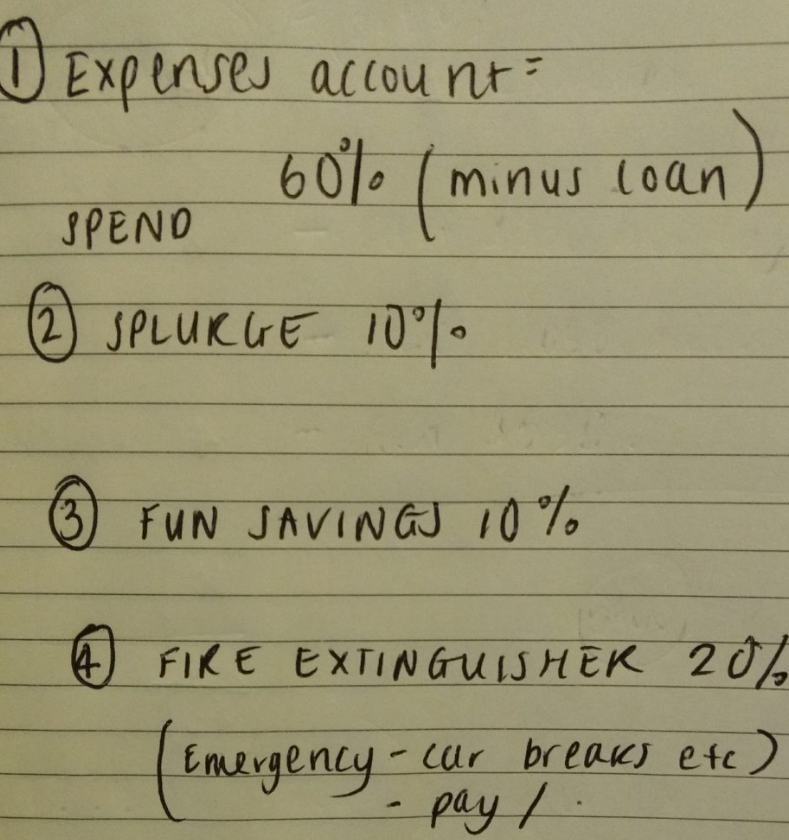

How many of you reading this have zero idea of where your Super is, how much is in there, and how many funds you have? That’s what we thought. And if you want to spend it on miniature ponies, the Barefoot community supports you. This stops the constant shuffling of money, “I’ll just transfer $40 from my savings for the completely unnecessary pedicure I got when my boss was being an arsehole”, and having a splurge account means that there is always money for what you want. Label one card ‘Daily Expenses’ and the other card ‘Splurge.’ Allocate 60% of your take-home pay to Daily Expenses (food, rent, bills) and 10% for Splurge (almond milk lattes, Domino’s vegan pizza, another amber-scented candle because it’s always good to stockpile, etc.) Having two debit cards that you use for different things is a great way of keeping track of what you’re spending, and having to think more about what you’re buying. Here are five everyday financial lessons we learnt from this pearl of financial wisdom: 1. And to top it off, it’s actually really entertaining. The Barefoot Investor by Scott Pape is an easy-to-follow guide that honestly helps make sense of complex finance talk. It has a huge impact on how we perceive money growing up and what we carry through into adulthood. So if they stressed about it, chances are that you will too. Turns out, our relationship with finance is pretty much established through seeing how our parents handle money.

0 kommentar(er)

0 kommentar(er)